Fundamental Look At Parkway Life REIT [Is It Worth Investing In?]

- Daniel Lee

- Jul 15, 2023

- 6 min read

Best Viewed On Desktop (As of June 2023)

In this article, we'll be conducting a fundamental analysis of Parkway Life REIT and its suitability to achieve the following investment objective: To deliver a stable dividend yield of 5% to 6% per year while having a high degree of capital preservation ability.

This article will be split into 6 sections:

For those looking for a quick analysis, you can just focus on sections 1 & 2 - summary of the analysis and personal opinion. For those who would prefer to have a deeper look into the financials, you can explore the findings in the other sections.

1. Summary of Analysis

Personal Opinion on:

Business Model: Parkway Life REIT is a well-managed healthcare REIT that offers a high degree of safety to its investors due to the nature of its properties and tenants. In terms of certainty of future distribution, Parkway Life REIT’s future distribution is both highly certain and inflation hedged given the long weighted average lease expiry (>15 years) and their tenant agreements (CPI-revision).

General Outlook: As Parkway Life is operating in the healthcare industry, they are somewhat insulated from the economic up and downs. Furthermore, Parkway Life REIT is positioned to capitalize on the demographic trends of the underlying country that they operate in - Singapore & Japan. As such, the outlook for Parkway Life REIT is stable.

Valuation & Expected Return: Based on historical performance, fundamentals and prevailing dividend yield, I believe Parkway Life REIT is currently overvalued. At the current price of $3.73, long-term investors (>10 years) can expect to receive a compounded annual capital return of -1% to 0% and a 3.5% to 4% annual dividend yield.

What My Actions Will Be: I have placed Parkway Life REIT on the watchlist and would invest in them should the valuations make sense. That said, given the defensiveness of the underlying properties, an opportunity may only arise as a result of major macro events that resulted in an indiscriminate sell-off in the market.

What to watch out for:

Downward price movements to identify pockets of opportunities to buy in (looking at the defensiveness nature of the counter, an opportunity might only come in an event of major macro movements)

What I like about the REIT:

The tenant agreement is super long which provides long-term certainty to unitholders

The company’s performance has been very stable and consistent. The nature of property and tenant is super defensive

The underlying land leases of property are long (Till 2070/80) and hence not subjected to the risk of lease decay

The management has managed to fund its acquisition and expansion into Japan using internal funds and cheap borrowings instead of units dilution

What I don’t like about the REIT:

The counter is too richly valued which makes it a bad investment

2. Personal Opinion

Given the historical valuation, group performances and dividend yield, I would consider Parkway Life REIT to be overvalued.

Moving forward, at the current price of $3.73, long-term investors (>10 years) can expect a:

1) Capital return: -1% to 0% per year

Undervalue: $2.88 and below

Fair Value: $3.00 to $3.15

Overvalue: $3.80

2) Dividend return: 3.5% to 4% a year

While I am confident in the group’s ability to deliver stable dividends over the years, the valuation is the major problem that makes this REIT investible. At a 3.5% to 4% dividend yield, there are much better alternatives that offer the same income yield at much lower investment risk and volatility.

3. Scenario Analysis

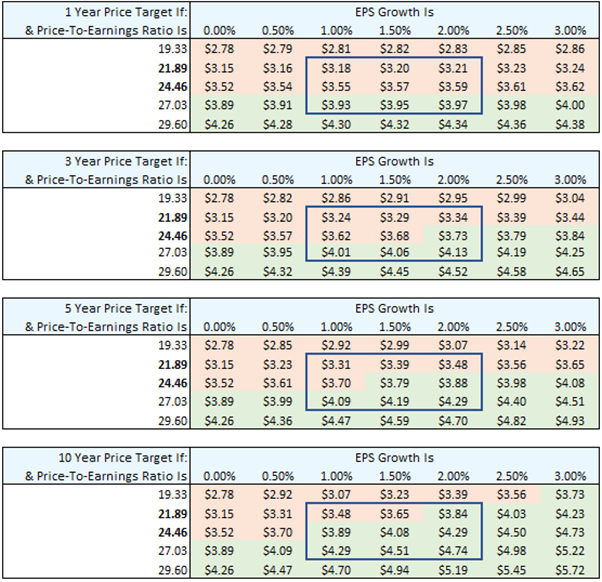

Cells within the blue box represent the most realistic scenario that has the highest probability of materialising. To read the table, the horizontals represent a change in the distribution income over time while the verticals represent changes in the investor's willingness to pay.

Boxes highlighted in red represents a loss while boxes highlighted in green represent a gain based on the current price level.

Projected Target Price

Projected Yearly Target Return

4. First Filter

For this, we will be examining key metrics revolving around the financial statements, namely:

Income Statement - to examine the performance of the group as a whole

Distribution Statement - to examine the behaviour of the total distribution over time

Valuation metrics - examine the “expensiveness” of the stock relative to its intrinsic value

The purpose of the first filter is to remove companies that are either:

Not profitable - which reflects either poor management or quality of assets

Inconsistent distribution - Pays out dividends from capital instead of rental revenue

Too expensive - in terms of valuation (as viewed from the lens of distributions)

Income Statement

Note: Net income includes income from JV which includes changes in fair value.

Findings:

From the gross income perspective, the group has posted healthy growth levels over the years.

From the property expense perspective, the management has displayed proficiency and consistency in managing expenses at around 7% of gross income - mainly due to the triple net lease agreement for their core properties.

In addition, the group has CPI-Revision clauses embedded in 60.7% of their tenancy agreement which ensures that their gross income and distribution are somewhat inflation-hedged.

Overall, the behaviour from the income statement displayed signs of stability in the bottom line revenue which fits the investment objective for a dividend investment.

Distribution Statement

Overall, distribution per unit has remained relatively stable over the years. It is impressive that the management had not diluted the units to fund their expansion and property acquisition in Japan. Moving forward, I expect the distribution per unit to come back down slightly as a result of a higher cost of borrowing.

Valuation Ratios

While the business model and performance of Parkway Life REIT have been stable over the years, the valuation and dividend yield has not been that attractive, especially since 2017 when the dividend yield has been pushed to below 4.5% as a result of rich valuations.

While Parkway Life’s REIT property offers investors a high degree of certainty in future distribution, there are much better alternatives that offer similar levels of yield at much lower risks. Therefore, from a risk-adjusted standpoint, such valuations do not make sense.

5. Second Filter

Now that we’ve established that the REIT is worth considering, let us examine the health of the business - namely balance sheet health and financing details.

Balance Sheet

Overall, Parkway Life REIT’s balance sheet is super healthy.

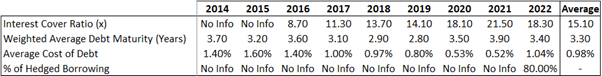

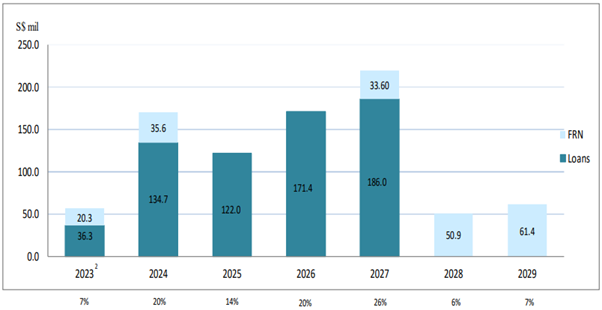

Financing Details

Given that a good chunk of the borrowing is expiring between 2024, we can expect the all-in financing cost to increase moving forward and remain at that level for a good amount of time until the interest rate comes back down.

Even though a good chunk of the borrowings is hedged, the need to refinance during the high-interest rate environment will still put significant upwards pressure towards the all-in financing cost of the group.

As a result, ceteris paribus, we can expect the distribution amount per share to continue to decline as a result of higher financing costs which will eat into the net profits.

6. Third Filter

The last consideration that we will be examining would be the nature of the underlying properties and their tenants.

Underlying Properties

Findings:

The nature of properties is well positioned for the long-term structural trend of the underlying country - Japan (nursing homes) & Singapore (Hospitals)

The strategic expansion focuses mainly on Japanese nursing homes, which are well-positioned to capitalize on the current stage of their aging population

Super long weighted average lease expiry with favourable lease arrangement thereby providing long-term stability and certainty in distribution

Lease of properties is decently long (Singapore: 50-60 Years, Japan & Malaysia: Freehold)

If you've found this analysis useful, you can consider checking out my eBook: “The Price Of Financial Freedom” which will provide you with a comprehensive guide to help you achieve financial freedom and live life on your terms in the shortest amount of time.

You can download a copy of it for free on my website:

If you do not know how to get started with your financial planning or if you do not have the time to manage your finances, you can consider engaging an Independent Financial Advisor who can help you make sense of the market, accelerate your progress and achieve financial freedom by 5 to 10 years earlier!

To find out more information about how you can benefit from my financial and investment planning services, you can check out what I do on my website here:

Daniel is a Licensed Independent Financial Consultant with MAS and a Certified Financial Planner (CFP®).

Connect with me on social media platforms to receive updates on future content! You can also slide into my DMs if you have any questions :)

Disclaimer:

This article is meant to be the opinion of the author

This article is for information purposes only

This article should not be seen as financial advice

This advertisement has not been reviewed by the Monetary Authority of Singapore

![[Market Updates] 2025 Quarter 1](https://static.wixstatic.com/media/5dc7f7_8079356886c44fec84d91388db5685ec~mv2.png/v1/fill/w_243,h_137,fp_0.50_0.50,q_95,enc_avif,quality_auto/5dc7f7_8079356886c44fec84d91388db5685ec~mv2.webp)

![Is CDL Hospitality Trust A Good Buy In 2025? [Fundamental Analysis]](https://static.wixstatic.com/media/5dc7f7_90cdc9cecbde4d28b3df8b22215a37eb~mv2.png/v1/fill/w_243,h_137,fp_0.50_0.50,q_95,enc_avif,quality_auto/5dc7f7_90cdc9cecbde4d28b3df8b22215a37eb~mv2.webp)

Comments